One of the most prestigious degrees in the financial industry is the Chartered Financial Analyst (CFA). In this article, we will take an in-depth look at the CFA program and the job opportunities it offers, because pursuing a successful career in finance requires not only commitment and passion, but also the right skills.

The CFA title at a glance

The Chartered Financial Analyst (CFA) is an internationally recognized title awarded by the CFA Institute. This certificate is the gold standard for professionals in investment management, portfolio management and securities analysis. The program is known for its demanding training and rigorous examinations, which are divided into three levels.

- Level I: Emphasizes the fundamentals of investment tools and concepts.

- Level II: Focuses on applying these concepts to asset valuation and portfolio management.

- Level III: Tests your portfolio management skills and ethics.

Professional fields, where CFA holders work

The Chartered Financial Analyst title is a valuable seal of approval for professionals in the financial sector and opens up a wide range of career opportunities. After evaluating our candidate database, we have compiled the most common career fields that are accessible to CFA graduates:

1. Research Analyst

As research analysts, CFA holders analyze securities and companies to make recommendations for investment decisions. They are key players at investment banks, hedge funds and asset management companies.

2. Portfolio manager

CFA graduates are exceptionally qualified for the role of portfolio manager. They manage the investment portfolios of clients or institutional investors, make investment decisions and monitor performance.

3. Risk Manager

Controlling and assessing risks is crucial for financial institutions. They are well qualified to take on risk management functions in banks, insurance companies and other financial companies.

4. Sales Managers

CFA professionals can also work in sales, for example in supporting institutional investors or fund sales. It is not uncommon for them to already be able to look back on a career as a fund manager, which helps them in the argumentation and understanding of strategies when selling investment solutions.

Applicants with CFA are prefered for employment

But how good are the chances that the CFA title really offers?

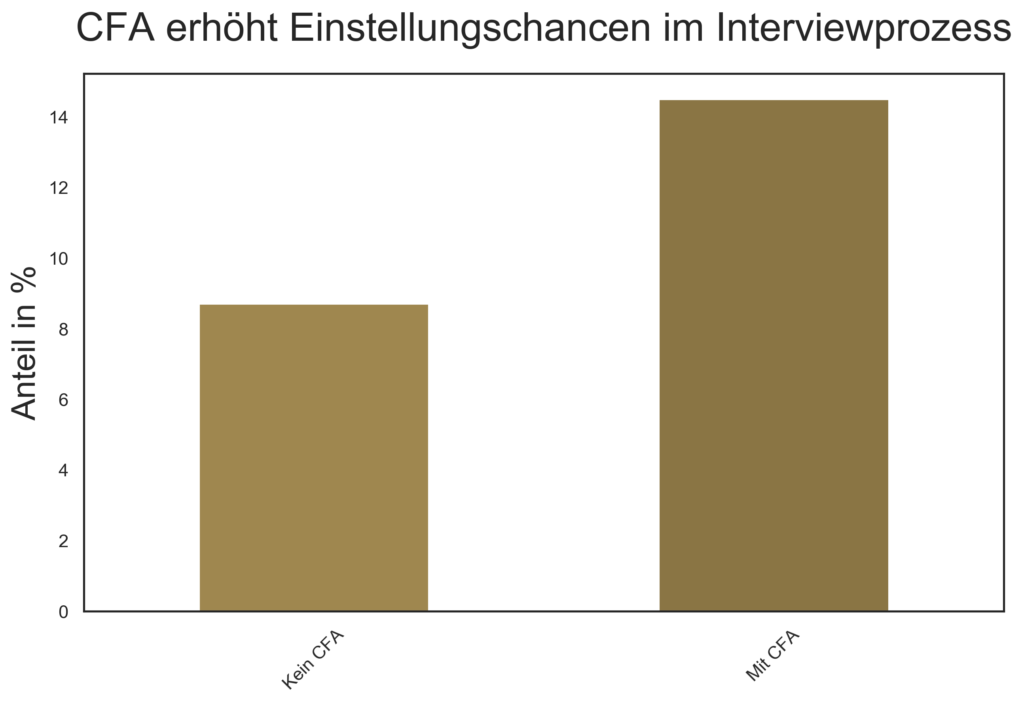

We first filtered our own CV database for candidates who either already hold the CFA title or are currently completing further training and working in the previously mentioned professional fields. A subsequent evaluation showed that there is a small but statistically significant difference between CFA holders/students and non-holders in terms of the chance of being invited for an interview.

The difference between candidates who have started or completed CFA training in getting the job at the end of the application process is almost twice as large and therefore clearly significant. Although a CFA title is not the only criterion when selecting applicants, at least in our sample 14.5% of the applicants interviewed by our customers for for jobs in the area portfolio management, research, risk management etc. had a CFA and only 8.7% haven’t had further CFA training.

Conclusion

The CFA title is an investment in your professional future in finance. It opens doors to high-level positions and offers the opportunity to stand out in a competitive market. If you want to be successful in the financial industry, getting a CFA title is undoubtedly one of the best decisions you can make. Follow the path of excellence and take advantage of the countless job opportunities that come with this coveted certificate.